Pivot #13: Steve Young let's do business

I have a TV mounted in my office that’s usually stuck on Bloomberg or CNBC. It’s mostly background noise, but also helps flag the headlines of the day and the direction of markets. Commercials are usually for orthotics, pharmaceutical drugs, or a new ETF. Recently catching my eye was marketing for Bloomberg’s Athlete Empire and an interview with HOF San Francisco 49ers QB, Steve Young. A great 24 minute video synthesizing the full hour long podcast interview and following Steve through his day is here:

The interview is loaded with insights and hockey players could take notes on the former football player. I recommend watching the video for anyone interested in 1) private equity or 2) pivoting from a sport. It’s the most tangible insight I’ve come across for an athlete finding success in PE. Young is a founding partner of middle-market private equity firm, HGGC, located in Palo Alto, California. Additionally, Steve is clearly passionate about helping athletes transition successfully into their second act. Let’s break it down.

First, absolutely stunning Steve Young is a minivan guy (4:55). Pragmatically speaking, Steve is accurate. A minivan is like a living room on wheels with a control panel at your fingertips. Highly efficient and comfortable. What Steve doesn’t appreciate is the wide gulf between him and the rest of us on the Cool Factor Scale. A minivan is barely a chink in the armour for him. He’s still a hard 9. The rest of us are chiseling for every marginal point of coolness we can get and a minivan is a clear headwind. You will continue to find me in the mid-size SUV category. And Steve, stop sandbagging us! We know you have a Denali and an X7 in the driveway too.

The Original Syndicate

Silicon Valley was exploding during Young’s career with the 49ers. The giants of tech today were emerging companies in the 90s. Young and teammates took notice of this trend and started leveraging what the players had–access. People wanted to be associated with the 49ers. It’s interesting across time and geographies “the athlete” is a desirable archetype to be associated with. The cool jock in high school, the child seeking the autograph, or the tech executive who wants to hang with an athlete are all examples of the same thing. It’s interesting players on the 49ers, recognized that and leveraged their status. This is a lever anyone currently playing sports could pull– professional or collegiate.

It sounds like in exchange for “access” the companies allowed players “in” as early investors. The players cobbled up $100-300k across 10-15 guys and invested in their world class deal flow. More important than the financial gains for Young was the rigor, insights, and questions these early deals brought about that compounded into his career in private equity. The early deal reps are critical to get you heading down the right path. As Young puts it, "Gain rigor and insights through your playing career. Because you’re asking the questions, you will figure it out. Keep asking questions."

Paralysis

It is normal for anyone to experience a degree of paralysis after their sporting career. Steve and his 49er teammate/business partner, Junior Bryant, elaborate on the shared sentiment after their NFL careers. The goal is to reduce the degree of paralysis. Not to sound redundant but experiencing early reps in something outside hockey is the best way to mitigate the aimless wander after a playing career. Think of your playing career as a time to experiment and discover interesting areas of the world. Go understand a car dealership business. Educate yourself on successful gyms and fitness facilities. What the heck is AI? Whatever your interest is, pursue the line of questioning.

Started early / You have time

Nagging from his father led Steve to plan earlier than he wanted to. Football wasn’t a viable long-term plan. After attending law school at BYU over the course of six years, Young earned his law degree in 1994. What’s even crazier is in 1994 Steve Young was named the league’s MVP and won the Super Bowl. If Steve Young was able to focus on becoming the best player in the NFL, lead his team to a championship and graduate law school, anyone can find time to educate themselves while pursuing greatness. If you don’t have time, it just isn’t a priority; it’s that simple. Young completed his degree over six years. Slowly chip away at whatever education you opt to pursue.

Young states, “Without the law degree, I wouldn’t get the opportunity to get into direct investing”. Who you know will open a door, but what you know will keep you in the door.

Value-Add

To paraphrase Young’s interview comments, player’s don’t realize how useful they’re playing career is; by definition of what they’ve been through (athletically) they have something to add. Reminder for players past and present to reflect on your own experiences and draw insights and lessons that extrapolate across settings. Too often, hockey players gloss over the self-examination piece, running through life unaware of the skillset they’ve built over time. It’s critical to understand the value-add that you are bringing to the table because you have to bring something. Become valuable.

Young’s value-add is very apparent. He’s a key confidant for HGGC portfolio company executives, an expert culture builder (more on that below), and an exceptional harvester of relationships, to name a few. These qualities directly translate to sourcing deal flow, winning company bidding wars, improving portfolio company performance and making HGGC a desirable workplace for talent. Do you think Steve’s experience taking over for the great Joe Montana helps him guide corporate CEO succession planning. You bet. Young understands he does not have the conventional 4 years of banking or consulting or the Ivy League MBA typically requisite for a path in PE, but that’s ok because of the other value-adds he brings to the table.

Culture

Steve holds a clear vision of his desired culture. It’s a refreshing take. I flag this as a unique insight because his cultural vision was built through football, heavily influenced by his head coach Bill Walsh, but it’s so obvious how this can translate to organizations of all kinds.

The Bill Walsh anecdote was fascinating. Walsh compiled a video archive of all his speeches, game planning, and sideline interactions, wrapped them up, and gave them to all his assistant coaches that became head coaches in the NFL. An interesting strategy to arm your competition, but a high ROI over the long term I bet.

At HGGC, Young is instilling a similar sentiment. Embracing young professionals, incentivizing employees for a long-term mindset, making people feel like superiors have your back. It’s a “spirit of abundance” Young calls it. Working in an environment where, from the top-down, the organization tangibly wants you to succeed is a great feeling. I’m sure we’ve all worked or played in the opposite before and understand how brutal it is.

Private Equity is an extremely relationship driven industry. PE professionals are very guarded with sharing their contacts and relationships. It’s a dog-eat-dog world for deals. For Young to take all his relationships and dump at the center of the conference table for the benefit of all is actually unique, and it concretely demonstrates the team aspect that he endeavors to build. The “Spirit of Abundance” strategy I’m confident has a high ROI because it helps HGGC gain trust of executives to win deals, improve company operations and attract/retain the best talent.

Culture is so important across organizations and is partially why athletes are desirable hiring candidates. It’s assumed athletes know a good culture, but that’s not always true. As a hockey player, think about the characteristics of cultures you like and how to implement that across verticals. That’s a unique value-add they don’t teach you at Harvard.

“Be an athlete”

Shamelessly, I love that Young uses this phrase because I talked about it in a prior newsletter. Young references the phrase a few times in the podcast version, not the video. He talks about Deion Sanders going from the playing field to being a great locker room guy to being a world class marketer consecutively in a day. He’s good at everything at once and Young made note of that as Sanders teammate. Young also talks about being “Emotionally Athletic” where he uses the analogy, “the best company CEOs are the men/women that can play the symphony”. In the symphony analogy and Dion Sanders example, “be an athlete” means regardless of the situation, figure out a way to excel. Be able to play every note. Understand how to communicate for every unique circumstance. Be an athlete. Just figure it out.

Roger Staubach advice - “Run!”

The Dallas Cowboys legend, Roger Staubach, was Steve Young’s idol. Over time the two developed a friendship and prior to retiring from football Young asked Staubach for advice on life after football and Roger replied, “Run!”. Meaning Young shouldn’t go looking for the game. Quit hanging around football because football will always be there. Carve your path in something else because you’ll always have the experiences and relationships from the game that won’t leave you.

This is shrewd advice. It’s a sentiment I’ve continued to harp on for hockey players. Go do something outside hockey. Leverage the relationships forged through hockey to help on the new path, but go after something else. You'll always be the hockey player walking into a room. No need to crutch on that by laboring around the game.

Steve took this advice to heart. He was even hesitant to hang memorabilia from his career. His partners would hang jerseys and the next week Steve removed them from the office. It was not until several years into his investing career that Young gained comfort with embracing his football fame alongside his PE career. “I wanted fame to be a tool, not a weapon, and it’s so easy to weaponize,” Young said. Take Steve and Roger’s advice. Go do something else and don’t rely on being the hockey player. It won’t get your far. It sounds very similar to the advice Danny DeKeyser received from former Detroit Tigers outfielder, Andy Dirks, that we profiled in Pivot #5.

Athlete Wellness

It’s clear Young isn’t leaving HGGC and private equity anytime soon. He loves it. However, his next endeavors seem clearly focused on athlete wellness. Everything from helmets and mouthguard technology, eyesight monitoring for concussions, financial literacy for athletes and helping players transition from their playing careers. Young mentions his idea of building a repository of athlete success stories that can help young players plan their own transition from sports. Hmm, Steve I think I know a guy doing something like that! Hit me up Steve. I think we’d make a good D-to-D, Lefty/Righty pair on the blueline.

Sports is more and more embedded in our culture and the tailwinds for player wellness are only going to increase, in my view. For example, as sports franchise value continue to skyrocket, more capital will be invested in improving the franchise assets– the players. Athlete wellness is an interesting investment niche to monitor going forward.

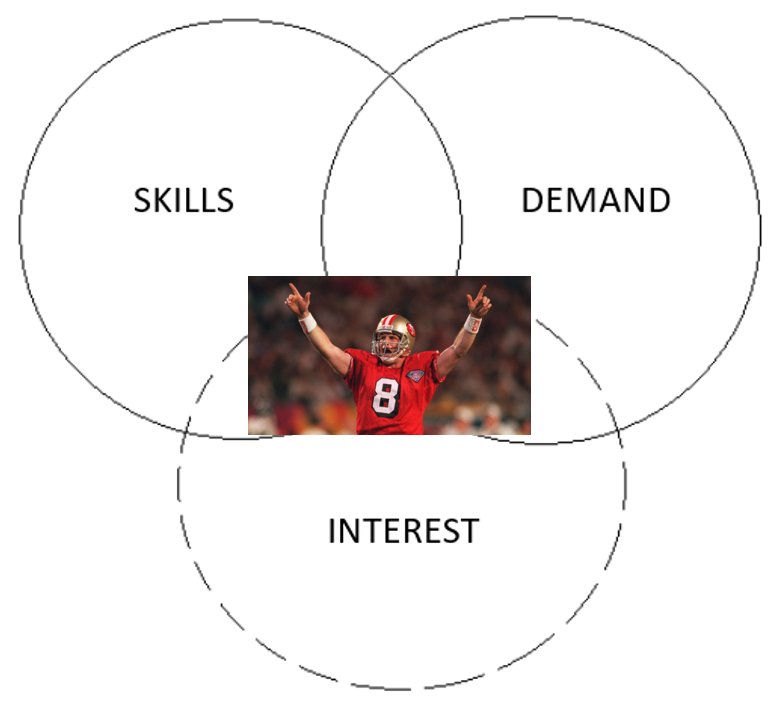

Center of the Pivot Framework

Steve Young is living a life of high well being. He fits the Pivot Framework perfectly, living his life at the overlap of his skills, interests, and industry demand. Over a long period of time he’s built a a symbiotic relationship across facets of his life, including business, family, philanthropy, football, and friends.

Steve says he has found his “common center” in life. Through his football career, private equity career, charitable foundation and broadcasting career he’s created this flywheel effect where each facet builds on the next, and he can center himself, friends, and family at the center of the wheel to experience each facet.

Takeaways: Get early reps during your playing career. Ask questions. Seek education. You have time. Be a value-add. How can you influence culture? Pursue something outside of hockey. Understand the wellness resources available. Keep the Pivot Framework model in mind.

Game Notes

- As college sports faces more change, is private equity money coming in? - ESPN

- Justin Morneau Creates an Icy 'Field of Dreams' - YouTube (this is dreamy)

- Fed says more 'confidence' needed on inflation front before rate cuts can start - Reuters

- Royal Palm Beach High School prepares students for HVAC careers after graduation - WPTV

- Quick aside: my cynical take on this sort of topic is so many people talk about the trades, the trades, the trades! "You wouldn't believe what my plumber charged me!" Folks clamoring to get kids working in the trades, which I agree with. But the tone always seems to come off a little high brow, in my view. Like it's some white collar, upper middle class dude exclaiming this, yet sending his own kids to college. There's a certain "good for thee, but not for me" vibe to it. When push comes to shove, it's like their status is in jeopardy if the kid doesn't go to college? I find it comical. My general take is if my child wants to go into a trade, they should pursue it, but figure out a way to own the plumbing/electrical/HVAC/trade company. Build equity. You don't want to be laboring for someone else forever.

- On a similar note: Stanford currently has 865 undergrads majoring in computer science and 16 (!) majoring in civil engineering - X

- Birth Rate Plunging as Millennials Decide Against Being Parents - Study (I had my guy)

- Math behind media advertising - LinkedIn

- 3 reasons the US economy's strength right now is a head-fake, according to Mohamed El-Erian - MSN

- Generally agree with this take on the country's economic resiliency - X

- Tech layoffs balloon in January - CNBC

Thanks for reading. Comment. Tell a teammate. Pass the newsletter along. Reach out with questions. Enjoy the NFL Bye/NHL All Star Weekend.

Member discussion