Pivot # 10: Victor Bartley's Real Estate

I was Googling around, doing some research and came across an interview with former NHL defenseman, Victor Bartley, on the podcast ‘Puck to Properties’ (Links: YouTube, Spotify). If you’re a hockey player interested in real estate, the podcast may be for you. I’ve only listened to the one episode, but there seems to be a lot of overlap with the podcast’s mission and Pivot’s goals. Check them out. Bartley built a real estate portfolio while patrolling the blueline for the Nashville Predators and then later went on to start Sixty Four Investments. His current portfolio includes 3 residential properties, 2 commercial properties, and it sounds like he acquired and sold several properties over the past few years. The interview was packed with insights. Let’s break it down.

Self-Reflection + Strategic Thinking

(watch these next two clips)

It struck me as impressive, Vic’s ability to step back from day-to-day hockey life and think strategically. Get big picture. Take the 30k foot view and reflect on himself and the trajectory of his life. He clearly understood he was a “league minimum” type of player. What I really appreciate about the self-reflection is Vic didn’t take the 'enjoy-the-moment' and 'hang on as long as you can' approach. Instead, he saw opportunity. He recognized the fat, recurring revenue that even a league minimum contract brings, and knew he had the opportunity to leverage the cash flow and turn it into long-term earnings that could outlast his career.

Every player would benefit from detaching from the situation they find themselves in and strategically think about where life is headed. Having a better understanding of yourself from athletic and life standpoints helps inform next steps and the path to start trekking down. Everyone should set aside time weekly to reflect.

Bartley knows he’s league minimum and in sharp contrast to teammates like Shea Weber and Roman Josi whom have tens of millions in NHL contract earnings in the bank or in future direct deposits. Frankly, it would be a complete waste of time for Shea Weber to concern himself with a $300k rental property that cash flows a couple grand per month. That’s an inefficient use of his capital. He’s looking for different types of deals compared to Bartley. It’s impressive Bartley was able to delineate himself from teammates and not get sucked into the financial lifestyle that he could ill-afford long-term.

Start Early

Even more impressive than Bartley’s ability to self-assess was he actually translated his assessment into immediate action. Vic started immediately. He spent his first two seasons worth of earnings on buying rental properties, living off his Amex card in the summer (this is not financial advice). Similar to sentiment in previous Pivot Newsletters, the earlier you start, the better, and Bartley embodies the philosophy. By starting early, Vic was able to put his NHL salary to work sooner and leverage his status as a Predators player to build valuable relationships throughout the city.

The benefits of starting early are threefold for Vic: 1) Built a Skillset - he’s capable of running a full real estate process through the reps of constructing his real estate portfolio. Buying, selling, renovating, negotiating, leasing, sourcing are all skills he’d have to learn if he were to start on Day 1 of retirement. 2) Easier Transition - Vic spared himself the frustration of “what’s next?” when he fully departs from the game. Vic already knows how he wants to spend his time and will hit the ground running 3) Financial Benefit - he has rental income flowing and a seemingly profitable business that can help support him and his family whenever he opts to retire from hockey

Educate Yourself

My favorite quip from the entire interview is Bartley’s commenting on player habits watching Netflix and playing video games. At the end of the day, players need to take responsibility for the position they put themselves in post-hockey. Cut in to your Netflix or video game time and be productive at something that’s going to benefit you long term. You don’t need to spend every free moment working, but an hour or so every week compounds over time.

Pivot Framework - Demand

After watching the above clip, many of you, I’m sure, are asking, "Is Victor Bartley a Pivot Consulting client?" To come clean, he is not. I don’t know Vic. But his comments sure fit the Pivot Framework nicely.

Vic recognized the unique characteristics of Nashville. Known for Music Row and its honky tonks, the city doubles as a large college town home to Vanderbilt University and Belmont University. It doesn’t take a college degree (Vic’s own admission, not mine) to figure out there’s strong demand from dads for new, safe, walkable living accommodations for their sweet little, southern belle, sorority girl daughters.

Vic used his entire first two seasons of salary to scoop up $300k properties with 20% down payments. The blueliner was making $600k back then, so assume his take home pay was $300k after taxes and other deductions, or netting about $25k in each of his twelve pay checks. He’s putting $60k down, paying $900 on his monthly mortgage, and charging $2,600/month in rent. Say Vic has another $500 for property taxes, insurance, maybe an HOA fee, whatever else. He was cash flowing $1,200 a month ($2,600 - $900 - $500), resulting in an annual 24% cash-on-cash return on the down payment. Impressive. He did all this by thinking to himself, “What is in demand?” and allowing the answer to guide his pursuit.

Pivot Framework - Interests

Bartley is fortunate to find something he appears to be as passionate about, in real estate, as he is hockey. Find something you can't wait to go home and Google more about. Something you have endless questions about. That’s likely the subject you’ll be eager to pursue. Mondays will feel less like Mondays and turn into another day you can get up and get to work. Throughout the episode, the passion in Vic’s voice is evident. He’s educating teammates, chatting real estate on the training table, and even developing his D-partner relationship through real estate. Overlapping the Passion/Interests circle of the venn diagram with Skills and Demand will make Victor Bartley’s pivot into post-hockey life all the more easier.

Other quick little insights from the interview:

- Informal education is powerful - Google and YouTube all your questions. You can teach yourself everything. Don't be afraid to approach people on social media. Don't be afraid to ask questions.

- Surround yourself with great teammates - For Vic, this includes lawyers, tax accountants, brokers, and his partner on a couple of the deals, The Cauble Group.

Follow-up questions for Barts if I get the chance to interview him...

- Explain more about your company, Sixty Four Investments? Is it a real estate investment company? Is it a consulting/educational company? Both? I’m curious to know more about this

- How has business and/or your strategy changed given the new interest rate environment?

- How do you invest in properties from afar (i.e. properties located in other cities)?

- Walk us through your first investment when you were with the Predators? How much of the work did you do yourself? How did you balance your NHL schedule with acquiring a property?

- How did you connect with The Cauble Group? What is each partner bringing to the table?

- How did you find other parts of your team: attorney, tax accountant, etc?

Game Notes

- The World’s Most Famous Soccer Club Just Put Its Fate in the Hands of a Cycling Guru - WSJ - Great excerpt from the article:

At the heart of all of it was the Brailsford gospel of “marginal gains.” The philosophy meant targeting every possible advantage, however minute, if it improved the team’s performance by even a fraction. If that meant traveling to the Tour de France with their own custom mattresses and hypoallergenic sheets, then Brailsford was prepared to do it.

- How much caffeine should you actually have and when? - WSJ

- The most famous and influential Bank Equity Analyst is a powerlifter - Bloomberg

- Athlete taxes in PA could be changing:

The NHL Players’ Association and NHL players Kyle Palmieri and Scott Wilson were among plaintiffs who sued the city of Pittsburgh in 2019 over its "jock tax" on non-resident sports stars.

— Rick Westhead (@rwesthead) January 10, 2024

The plaintiffs argued that since 2005, the city has unfairly levied a 3% earned income tax…

- US Bitcoin ETFs see $4.6B in volume in first day of trading - Reuters

- How Texas A&M’s Deal with Qatar ‘Puts American Security at Risk - Free Press

- Insane article. TLDR - Texas A&M is a top university for nuclear engineering. Qatar is funding the entirety of its research program IN TURN for the entire rights, title, and interest of all the tech and IP. Qatar is a top ally to Iran and the home to top Hamas leaders. What could go wrong?!

- Victor Wembanyama Sets Course to Become a Basketball Billionaire Unlike Any Other - Bloomberg

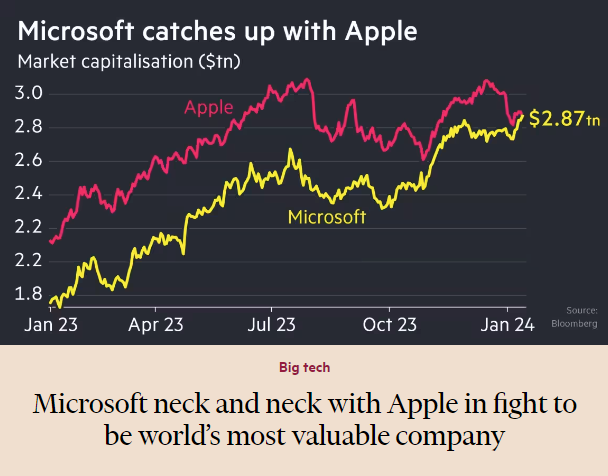

- $AAPL vs, $MSFT

Thanks for reading. Pass along to a teammate. Leave a comment below. Reach out with questions.

Member discussion